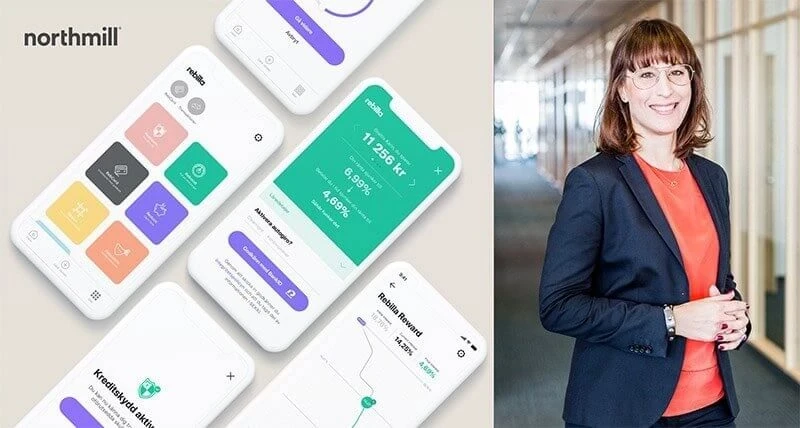

Northmill introduces WeMeet

First bank to offer personal video calls

The neobank Northmill, the highest ranked bank on Trustpilot in Sweden with a rating of 4.8 out of 5, continues to focus on customer experience by introducing WeMeet. Customers can book a personal video meeting with a customer service representative and get help with their personal finances. Northmill, which recently stepped into the business segment, sees the initiative as an important step towards creating an intelligent, relevant and personal banking experience.

Tord Topsholm, CEO at Northmill, comments:

“The introduction of WeMeet sends a strong signal on how we choose to differentiate ourselves and define our position in the market. Many bank customers feel overlooked in the midst of the powerful digital transformation we are in. The importance of the personal meeting has been forgotten. Customers have ended up in limbo and we understand their frustration. Therefore, we want to show that you can be a true technology-driven company - a neobank - and be personal at the same time. This is Northmill's goal. We see the same thing happening in other industries, such as health-tech, where the need to feel secure is crucial. Even though we are first among the neobanks, I predict that we will not be the last.”

WeMeet’s first version is now launched, and it has previously been test-launched with a great response among Northmill users.

Daniel Karlsson, Head of Customer Center at Northmill, comments:

“We see a global trend in several sectors, among them banking, where customer service is being downgraded. It’s the wrong way to go. We talk to our customers every day and have seen a growing need to be able to offer a personal meeting. That’s the main reason we are introducing WeMeet. The fact that we’ve already managed to have an average response time of two minutes, and a customer satisfaction of over 90 percent, doesn’t prevent us from scaling up further. When it comes to people's financial health, trust is very important - and the possibility of a personal meeting plays a big role. It will be very exciting to explore this next step. We already have several ideas on how to develop WeMeet to assist and educate people further, in order to help them improve their personal finances. And of course, we make it available to all customers at the same time.”